Chittagong Industrial Park LTD

Who We Are

The Government of Bangladesh initiated a bill on Private Export Processing Zone and within a very short period of one month enacted it into a law. The Private Export Processing Zone Act 1996. The first meeting of the newly formed Board of Governors, under Private Export Processing Zone Act, was held in October 1996. Following this meeting our proposal to set up an Export Processing Zone under private sector in Rangunia Thana of Chittagong District under the name and style "Chittagong Industrial Park Ltd" (CIPL) was approved in the Board of Governors meeting held at the Prime Minister's Office on March 29, 1998 under Section of Bangladesh Export Processing Zone Act 1996 to set up the Rangunia Export Processing Zone (REPZ) under the sponsorship of "Chittagong Industrial Park Ltd" which will be the first EPZ of the country in the private sector sponsored by the local entrepreneurs under joint venture with the foreign investors.

The site designated for the establishment of the Chittagong Industrial Park is in the district of Chittagong. Chittagong is a port city situated in the southeast of Bangladesh, bordering the Bay of Bengal and Mayanmar.

It is 260 km by road from the capital city of Dhaka. It is also the main export point of Bangladesh and is well equipped, generally, with modern port facilities, good network of roads, having a sub-tropical climate, Karnaphuli River, which is suitable of alternative or of inland transport.

Being in general is a flat alluvial land but within the district of Chittagong especially on the rim of perimeter of 30-40 km, the land consists of undulating hills ideal for formation of industrial parks.

The site of the Chittagong Industrial Park Ltd. is located about 30 K.M from the Chittagong City on the way to Kaptai on the northern side of River Karnaphuly.

-

Chittagong Industrial Park Ltd.

CIPL

(Sponsor Company)

-

Rangunia Export Processing Zone

REPZ

(Name of the Project)

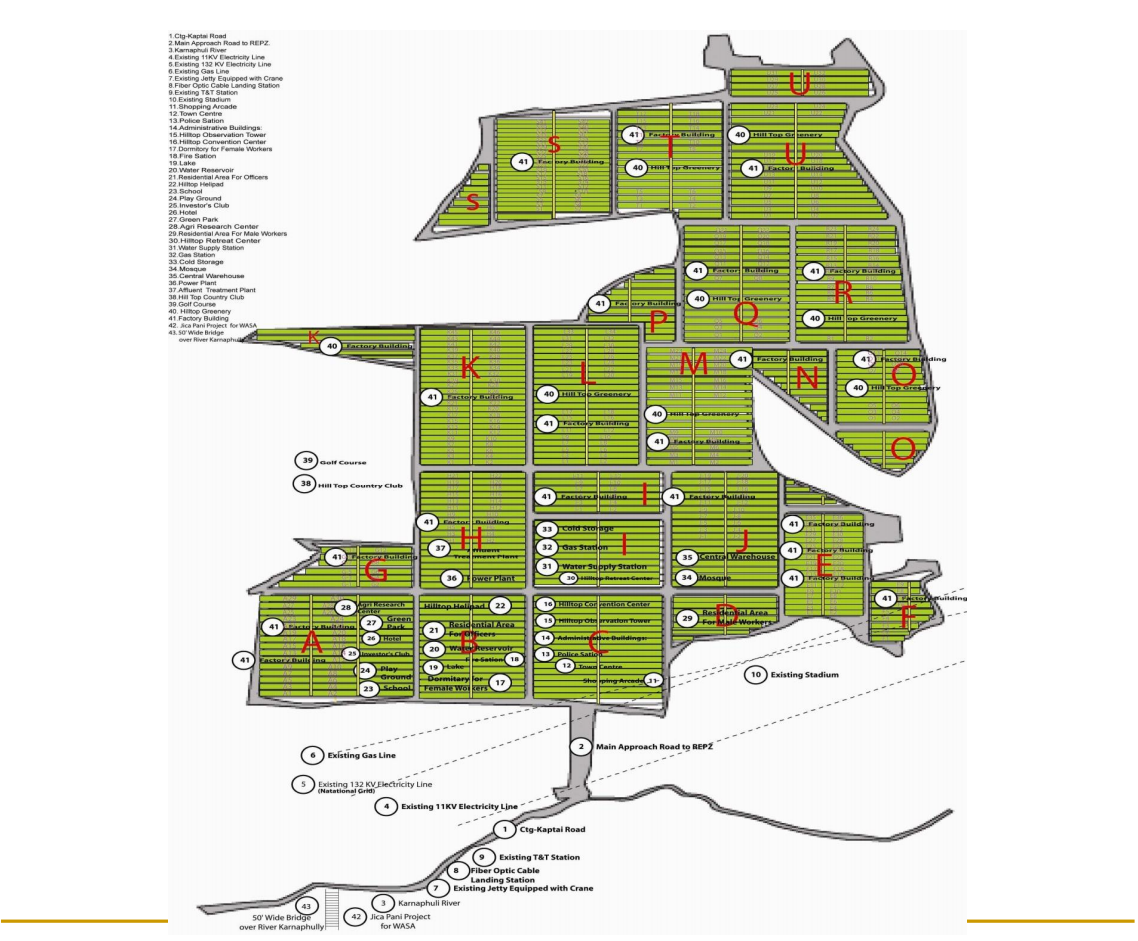

Earmarked Areas of the REPZ

-

Information Technology (IT) Valley

Agro Valley

Salient features of Private Export Processing Zone Act. XX of 1996 are as follows:

- Entrepreneurs setting up industrial units in the REPZ shall be allowed to import all the construction materials duty free.

- Entrepreneurs setting up industrial units in the REPZ shall be allowed to import and export 100% of their raw materials and finished products duty free.

- Income of the entrepreneurs in the REPZ shall be 100% income-tax free.

- Repatriation of the income and profit of the entrepreneurs in the REPZ shall be allowed 100%.

REPZ investment

Solicit long term investment to develop the infrastructure of the zone

Solicit investment for the development of Rangunia EPZ (REPZ) by Foreign Direct Investment (FDI) by any prospective investor on the basis of either a Joint Venture Company, or on Joint Ownership Company or Built Operate & Transfer (BOT) or Built Operate & Own (BOO) or on any other mutually agreed terms and conditions with CIPL and the prospective investors.

Facilities

Proposed Development Of Back-Up Infrastructure For Rangunia Export Processing Zone:

- Internal roads

- Boundary walls, culverts, bridges, etc

- Hilltop observation tower

- Hilltop convention center.

- Hilltop retreat center.

- Control tower & hilltop helipad.

- Police station.

- Water supply station

- Gas supply station.

- Power station.

- Maintenance of existing jetty equipped with 200 metric ton capacity crane.

- Residential area for officers.

- Residential area for workers.

- Residential area for female workers.

- Central affluent treatment center.

- Central cold storage.

- Factory buildings.

- Central warehouse.

- Hilltop water reservoir.

- Lake.

- Greenery.

- Fiber optic cable landing station.

- Existing stadium.

- Hotel.

- School.

- Hospital.

- Mosque.

- Shopping arcade.

- Town center.

- Play ground.

- Green park.

- Golf course.

- Hilltop Country Club.

- Fire Station.

Administrative buildings :

- Office building.

- Customs.

- Banks.

- Post Office.

- Courier/ Cargo handling office.

- IT office.

- Environment office.

- Forest office.

- Test laboratory.

Private Epz Act Allows The Following Facilities And Incentives To The Investors In Rangunia Epz:

Proposed Development Of Back-Up Infrastructure For Rangunia Export Processing Zone:

- Internal roads

- Boundary walls, culverts, bridges, etc

- Hilltop observation tower

- Hilltop convention center.

- Hilltop retreat center.

- Control tower & hilltop helipad.

- Police station.

- Water supply station

- Gas supply station.

- Power station.

- Maintenance of existing jetty equipped with 200 metric ton capacity crane.

- Residential area for officers.

- Residential area for workers.

- Residential area for female workers.

- Central affluent treatment center.

- Central cold storage.

- Factory buildings.

- Central warehouse.

- Hilltop water reservoir.

- Lake.

- Greenery.

- Fiber optic cable landing station.

- Existing stadium.

- Hotel.

- School.

- Hospital.

- Mosque.

- Shopping arcade.

- Town center.

- Play ground.

- Green park.

- Golf course.

- Hilltop Country Club.

- Fire Station.

Administrative buildings :

- Office building.

- Customs.

- Banks.

- Post Office.

- Courier/ Cargo handling office.

- IT office.

- Environment office.

- Forest office.

- Test laboratory.

Administrative buildings :

- Office building.

- Customs.

- Banks.

- Post Office.

- Courier/ Cargo handling office.

- IT office.

- Environment office.

- Forest office.

- Test laboratory.

All facilities and package of incentives are allowed for REPZ under Private EPZ Act XX of 1986 as allowed for the EPZs in Public Sector as mentioned hereunder:

Non-fiscal facilities

- All foreign investments are secured by law.

- All customs formalities shall be done at the factory gate.

- Import/Export permit shall be issued within the working hour, etc.

- Full repatriation of profit, capital & establishment.

- Enjoy MFN status.

- Foreign currency loan from abroad under Off-Shore Banking Unit (OBU) facilities.

- Non-resident Foreign Currency Deposit (NFCD) allowed for ‘A’ type industries.

- Operation of FC account by ‘B’ and ‘C’ type industries allowed.

Fiscal incentives

- 02 (two) years tax holiday followed by 50% reduced rate for the 3rd and 4th years and 25% rate for the 5th year.

- No income tax on interests on borrowed capital.

- No ceiling on foreign investment.

- No double taxation.

- No duty on import of machinery, equipment and raw materials.

- No duty on import/export.

- No duty on import of construction materials for construction of factory buildings in REPZ.

- Inter-Zone export permitted.

- Sub-contracting within REPZ allowed.

- Re-location of existing industries from abroad allowed.

- Exemption from dividend tax for tax holiday period

- Sale of 10% finished products except garments to Domestic Tariff Area (DTA) is allowed

- Sale of 10% defective finished goods to DTA is allowed subject to approval by a committee.

- Sale of 10% surplus raw materials to DTA is allowed.

- Income tax exemption of salaries of foreign technician for three years.

- Duty free import of two/three duty free vehicles for A & B type industries subject to certain conditions.

- Intra/inter zone sub-contracting & transfer of goods allowed.

- Sub-contracting with Export Oriented Industries inside and outside EPZ allowed

- No UD (Utilization Declaration), IRC (Import Registration Certificate), ERC (Export Registration Certificate) & renewal of bond license required.

Site and location

The access to the project site is the Kaptai road. The Kaptai road links the project site with Chittagong City. Project site is located within 30 k.m. from Chittagong City and within 10 k.m. from Kaptai. Within 2 k.m. from the project site, across Chittagong-Kaptai Road, on the bank of River Karnaphully a jetty with all the back-up logistics is already built by BPDB (Bangladesh Power Development Board). The jetty can be used for transportation cargoes by barge to and from the main Chittagong Sea Port for import and onward shipment to the international market by ocean going ship.

The road network around the area includes a newly constructed bridge crossing over the river Karnaphuli within 3 k.m. from the project site is a unique cut-short road passage to Cox's Bazar on ward to Myanmar and Far Eastern countries.

the geographical location gives enormous benefits and competitive advantages such as

- Accessibility to markets in Myanmar, a country having a population of 40 million people

- Accessibility to markets in the seven sisters sates of India having a population of 250 million people.

- Accessibility to untapped markets in Bhutan, Sikkim and Nepal,

- Alternative 'door' to one of the biggest market in the world - China. Namely south - western part of China, a regional

- Bangladesh being one of the emergency supplier of trained and easily to be groomed manpower in the global market of information technology, computer software and computer hardware, importing countries may set up high tech industries in the REPZ, and can benefit from competitive advantage of low labor cost of trained manpower Chittagong University of Engineering and Technology (CUET) located within only 5 k.m. from the zone can be the immediate source of skilled workers needed for the high tech industries.

- To transmit computer software programs and data through fiber optic network can be an added advantage to the entrepreneur.

- The REPZ shall provide an unique job opportunities to the abundance supply of trained and to be trained workers of the adjoining CHT and rural areas.

- The zone being located very near to the Chittagong Hill Tracts the available thousands of sq. miles of the adjoining areas of the cultivable land for fruits and vegetables and Kaptai lake and Rangamati lake for hatchery and pisci-culture can provide a unique opportunity to the entrepreneurs to set up export oriented agro based industries in the zone with abundance supply of raw materials as backward linkage from the cultivable land and lakes which are easily available within their reach.

Currently Bangladesh enjoys its major income from remittance from their workers working in all major industrialized nations from Europe to Middle East and Asia this in due to the particular fact that it has an enormous supply of the labor force and characteristically, the Bangladesh workers are easily molded and trained to suit the varied conditions of the host countries. It has a labor force of approximately 50 million, wages paid in comparison to the foreign countries, is comparatively very low, averaged at us $150 per moth.

With this opportunity predominantly available in Bangladesh the foreign relocated/ new industries should be able to overcome their current shortcomings.